reit dividend tax malaysia

6 in 2026 plus a separate 3 plus a separate 3 plus a. Unlike the dividend by individual stocks income distribution tax from REITs will get taxed before we received it.

Pdf Performance Determinants Of Malaysian Real Estate Investment Trusts

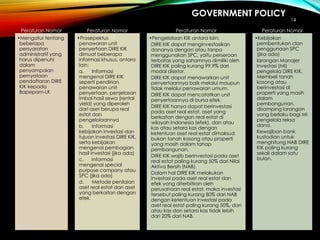

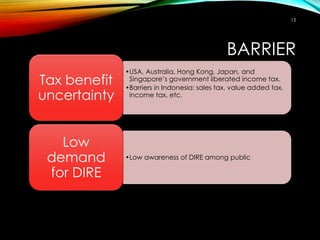

The government currently imposes a 10 withholding tax on REIT dividends to local and non-resident individual investors.

. You could buy reit for as little as rm200. Taxation of dividend income distributed by REIT in the hand of investors. Due to the complex ownership of REITs with everyone from individual investors to business ownership the Malaysian tax authorities impose whats known as a Withholding Tax.

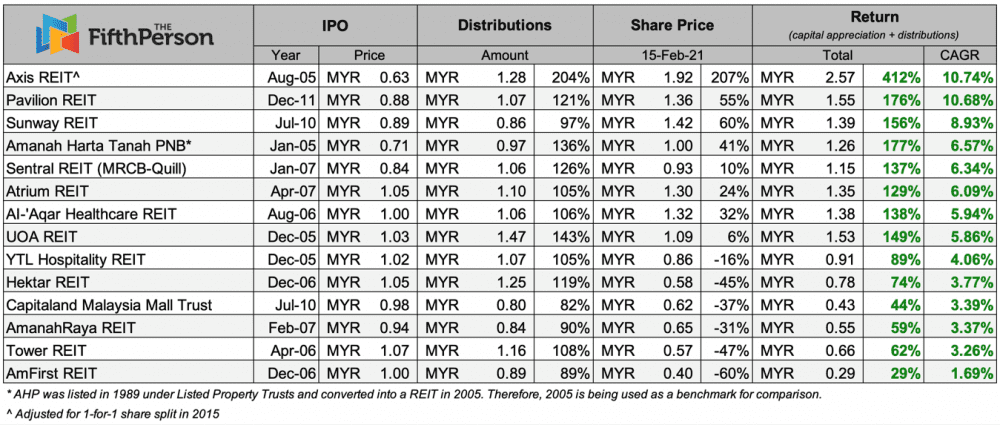

Their dpus shown in table above were annualised figures for the period between january and december 2021. 3 Years Continuous Growing. Is Reit Dividend Taxable In Malaysia.

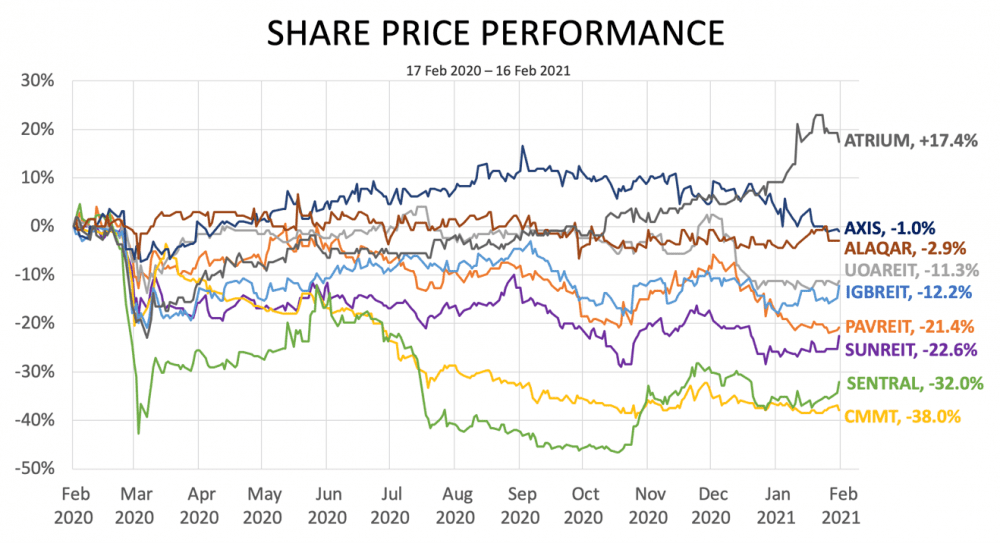

Of this 120 of the dividend comes from earnings. Divide the current REIT share price by the yearly dividend yield to arrive at the dividend yield per share. 686 Since 2007 every RM1000 investment in Sentral REIT previously known as MRCB-Quill REIT wouldve turned into RM1100.

19 rows Dividend Ranking. The Malaysian REIT sector as represented by the Bursa REIT Index is dominated by household. Since then not unlike ASB REIT sector had effortlessly and consistently brought from an average of 6-8 annual net dividend yield to double-digits yield circa 12 to 15 especially for investors who had the guts to go all in when the REIT prices bottomed back in 2008-2009.

The remaining 060 comes from depreciation and. Dec 2011 Male MYS. If the REIT distributes quarterly dividends multiply the most recently reported dividend payment by four to get the estimated payouts for a year.

Dividends from REIT companies are taxed at a maximum rate of 37 returning to 39 percent. Withholding tax of 10 or 25. Dividends received by REITs are taxable as ordinary income up to a maximum rate of 37 returning to 390.

The taxation of dividends in Malaysia is subject to a single-tier system and those dividend payments made by companies under this system are not subject to tax. Reit dividend tax malaysia Monday March 14 2022 Edit. Amanah Harta Tanah Annualised return.

The REIT generates 2 per unit from operations and distributes 90 or 180 to unitholders. However unit holders are liable to tax on the distribution of income. In a case where dividend income forms part of the total income distributed to unit holders the tax credit from tax at source is given to the REITPTF and the tax computation at REITPTF and.

Frasers Property declared a dividend of 20 cents per share for FY2021. Including dividends every RM1000 would cumulatively become RM2370. Dividend payout is done on a quarterly basis ie.

For REIT in Malaysia this is charged at 10 for individuals. In Malaysia Reits Are Only Allowed To Borrow Up To 50 Of Their Total Assets The Limit Has Been Temporarily Increased To 60 Until The End Of 2022. One more big plus for REITs is that they are exempt.

Additionally taxpayers can generally deduct 20 of the combined qualified business income amount which includes Qualified REIT Dividends through December 31. This is a tax charged on the payer of an income rather than the recipient. However the distributions made to the unit holders will be subject to withholding tax and will be received by the unit holders after tax has been paid.

Listed REITs in Malaysia are exempted from annual tax assessment if they distribute 90 of the years total income to unitholders. Taxation and tax exemption of REITs in Malaysia. Investment income is subject to an 8 surtax.

If a Real Estate Investment Trusts fund distributed at least 90 percent of their total yearly income to unit holders the REIT itself is exempted from tax for that year of assessment. According to this regime the corporate income tax imposed on a companys profits is in the form of a final tax and the distributed dividends are exempt from tax in the hands of the shareholders. By 2026 the rate will be 6 plus a third.

We will end up having only roughly 90 of the distribution. Some of the more well-off REITs in Malaysia are the AXIS-REIT which. Listed REITs in Malaysia are exempted from annual tax assessment if they distribute 90 of the years total income to unitholders.

If its a recurring payment multiply it by 12. REIT distributions are exempt from tax even though they are distributed at least 90 of the REITs total income during the year. REITs distributing less than 90 of their total income will pay tax at 24.

In such cases the distribution to the individual unit holders will carry a share of the tax credit which will be. Since the income distributed by REITs are tax exempt no tax credit under subsection 110 9A of the Income Tax Act ITA 1967. Sentral REIT Annualised return.

REITPTF level-subject to tax 2000-not subject to tax REITPTF 10000 -not subject to tax REITPTF 14000 Distribution from REITPTF Distribution from REITPTF Year 2 RM Year 1 RM 3.

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

Pdf Jurnal Teknologi A Review On Malaysia And Singapore Islamic Reits Regulatory Structure

Reit Company Indo Usa Malaysia Singapore

Reits In Malaysia 8 Core Categories Of Real Estate To Invest In Propertyguru Malaysia

Reits In Malaysia 8 Core Categories Of Real Estate To Invest In Propertyguru Malaysia

Reits In Malaysia 8 Core Categories Of Real Estate To Invest In Propertyguru Malaysia

Reit Regulatory Structure And Characteristics For Nigeria And Malaysia Download Table

Axis Reit Archives Dividend Magic

Reit Company Indo Usa Malaysia Singapore

Reit Company Indo Usa Malaysia Singapore

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

Reit Company Indo Usa Malaysia Singapore

Reit Company Indo Usa Malaysia Singapore

The Complete Guide To Reits In Malaysia Your Real Estate Partner

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Top 10 M Reits By Market Cap Rm B Source Midf 2016 Download Scientific Diagram